Uzbekistan has created a VAT office for foreign Internet companies

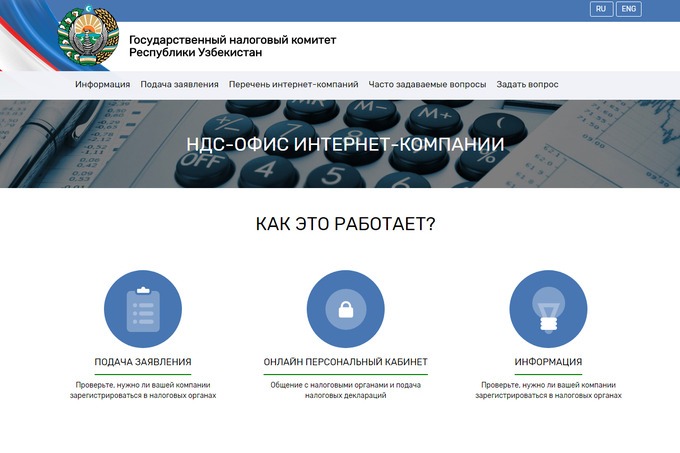

The State Tax Committee has created a website where foreign Internet companies can apply for registration as a VAT payer in Uzbekistan.

The State Tax Committee has provided the opportunity to register as VAT payers to foreign legal entities providing electronic services to individuals in Uzbekistan. For this, the site http://tax.uz was created.

Electronic services are understood as the granting of rights to use software, including games through the Internet, rights to use electronic books, educational materials, musical works and others.

This resource enables foreign legal entities to submit an application for registration as a VAT payer in the Republic of Uzbekistan and use an online personal account, submit reports and pay taxes, as well as receive answers to questions.

To gain access to your personal account, you must submit an application for registration. This can be done online in the Application Filing section.

To do this, fill out a form with the obligatory indication of the name of the company, its address, email, country of registration, information about the services provided.

It is necessary to attach to the application an extract from the register of foreign legal entities of the corresponding country of origin or another document confirming the legal status of the foreign organization.

If all the necessary information is provided, access to your personal account will be activated within 15 days, followed by notification by e-mail specified during registration.These registration rules do not apply to foreign companies providing services directly through their permanent establishments in the Republic of Uzbekistan. Such companies must register as VAT payers in the generally established manner provided for legal entities in Uzbekistan.

Given the novelty of the rules on the registration as VAT payers of foreign companies providing services in electronic form, and taking into account that the process of preparing technical capabilities takes some time, the STC does not intend to apply fines for late registration accounting.

Другие новости и события

Any use (reproduction, publication, copying, reprinting, distribution, translation, broadcasting, processing and other methods of distribution) of the materials of the Investment Portal - Invest.gov.uz, without indicating the original source and a link to the Portal is strictly prohibited!